Beyond the Vault: How AI Cameras Are Shaping the Future of Banking Security

Category: AI Camera,

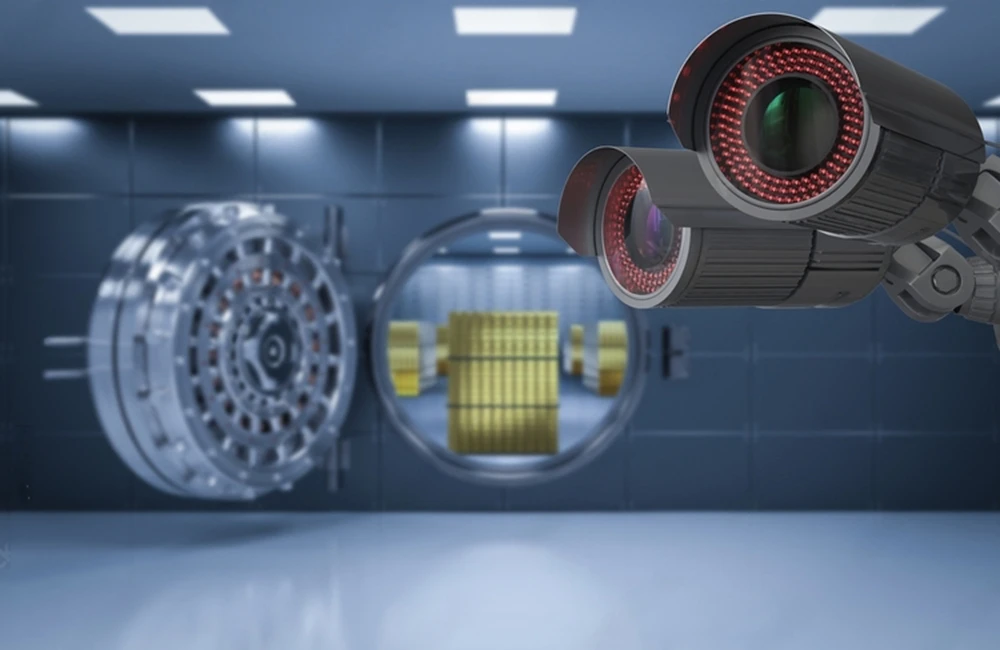

In the world of finance, where trust and security are paramount, AI cameras are emerging as silent guardians, ensuring that every transaction is not just recorded but protected with the precision of artificial intelligence. Join us on a journey into the heart of banking and finance, where the vigilant eyes of AI cameras are rewriting the rules of security and customer protection.

1. Branch Security: Safeguarding Your Transactions

- AI cameras play a crucial role in securing bank branches. Equipped with facial recognition and behavior analysis, these cameras monitor activities in real-time. They can detect suspicious behavior, unauthorized access, or potential security threats, ensuring that every corner of the bank is under watchful eyes.

2. ATM Protection: Defending Your Withdrawals

- ATMs are crucial touchpoints for customers, and AI cameras are enhancing their security. These cameras use computer vision to detect unusual activities around ATMs, such as skimming devices or suspicious behavior. This proactive approach helps prevent fraudulent activities and protects customers during their transactions.

3. Fraud Prevention: Detecting Suspicious Transactions

- AI cameras contribute to fraud prevention by analyzing customer behavior during transactions. Unusual patterns or discrepancies can trigger alerts, prompting immediate investigation. This ensures that fraudulent activities are detected and addressed promptly, safeguarding the financial interests of customers.

4. Customer Authentication: Enhancing Identity Verifications

- In the digital age, AI cameras are contributing to secure customer authentication. Facial recognition technology allows for seamless and secure identity verification. This not only enhances the customer experience but also ensures that access to sensitive financial information is granted only to authorized individuals.

5. Data Privacy Compliance: Upholding Regulatory Standards

- AI cameras in banking prioritize data privacy compliance. By adhering to regulatory standards, these cameras ensure that customer information is handled with the utmost care. This includes anonymizing data when necessary and implementing robust security measures to protect against unauthorized access.

Conclusion:

In the conclusion ever-evolving landscape of banking and finance, AI cameras are not just safeguarding transactions; they are fortifying the pillars of trust and security. From the moment you step into a bank branch to every digital transaction you make, the watchful eyes of AI cameras are ensuring that your financial journey is not just convenient but also shielded by the latest advancements in technology. The future of banking security is being shaped by the unblinking gaze of AI cameras, promising a world where your financial well-being is in safe hands.

CASE STUDIES

Case Study 1: JPMorgan Chase - AI-Powered Fraud Detection

Challenge:

- JPMorgan Chase, one of the largest financial institutions globally, faced the challenge of detecting and preventing fraudulent transactions across its vast customer base.

Solution:

- The bank implemented AI-powered fraud detection systems that utilized advanced analytics and AI algorithms. AI cameras were integrated into various aspects of the banking infrastructure, including ATMs, online transactions, and branch activities. These cameras, equipped with computer vision and machine learning, monitored customer transactions in real-time, identifying patterns indicative of potential fraud..

Outcomes:

- The implementation of AI-powered fraud detection significantly improved JPMorgan Chase’s ability to identify and prevent fraudulent activities. The system’s machine learning capabilities allowed it to adapt and evolve with emerging fraud tactics. As a result, the bank experienced a notable reduction in unauthorized transactions, enhancing customer trust and financial security.

Case Study 2: HSBC - Facial Recognition for Secure Customer Authentication

Challenge:

- HSBC, a global banking giant, aimed to enhance customer authentication methods while ensuring the highest standards of security.

Solution:

- HSBC introduced facial recognition technology as part of its customer authentication process. AI cameras were strategically placed in branches and ATMs, allowing customers to verify their identities seamlessly through facial recognition. The system compared the customer’s facial features with securely stored biometric data, ensuring a secure and user-friendly authentication process.

Outcomes:

- The implementation of facial recognition at HSBC streamlined the customer authentication process, reducing the reliance on traditional methods like PINs and passwords. The use of AI cameras enhanced security by providing a more robust and reliable means of verifying customer identities. The customer-friendly approach contributed to a positive user experience, reflecting HSBC’s commitment to leveraging advanced technology for both security and convenience.